Checking Designed for Your Life

Whether you want a free checking option or an interest-earning account, we have a checking solution that’s right for you. All of our personal checking accounts can be opened with just $50 and include a free instant-issue debit card, free digital banking and money management tools, free electronic statements, and unlimited check writing.

Review our checking account features to find the best option for the way you live.

BaZing

Checking-Dexter

Checking With Benefits

Enjoy everyday banking convenience plus valuable benefits, like cell phone protection, identity theft aid, roadside assistance and automatic participation in the BaZing Savings Network.

Enjoy everyday banking convenience plus valuable benefits, like cell phone protection, identity theft aid, roadside assistance and automatic participation in the BaZing Savings Network.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $51 fee reduced by $0.10 for every debit card purchase2 |

Interest

Checking-Dexter

Checking With

Interest

Make your money work harder with our interest-bearing checking account that keeps your cash accessible for when you need it. The higher your balance, the more you’ll earn with our tiered interest rates.

Make your money work harder with our interest-bearing checking account that keeps your cash accessible for when you need it. The higher your balance, the more you’ll earn with our tiered interest rates.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $0 for balances $500 and over |

Simply

Checking-Dexter

A Free Account for Everyone

Manage your finances quickly and confidently, with no monthly maintenance fees or hidden charges. Our free checking account is ideal for anyone just starting their financial journey.

Manage your finances quickly and confidently, with no monthly maintenance fees or hidden charges. Our free checking account is ideal for anyone just starting their financial journey.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $0 |

Advantage Checking-Dexter

Checking With Interest for Age 60+

Get rewarded for experience. Designed for individuals age 60+, this option has no minimum balance requirement, offers generous tiered interest rates and includes a free box of checks every year.

Get rewarded for experience. Designed for individuals age 60+, this option has no minimum balance requirement, offers generous tiered interest rates and includes a free box of checks every year.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $0 |

Review our checking account features to find the best option for the way you live.

- Cell Phone Protection is subject to a $50 deductible and additional restrictions. Roadside Assistance is subject to a $64.95 fee per use and additional restrictions. Enroll in ID theft aid through BaZing website. Please see a customer service representative for a printout of the terms and conditions. Terms and conditions are also available when you sign into your account at BaZing. Insurance products are not a deposit, not FDIC insured, not an obligation or guaranteed by the bank, its affiliates or any other government agency.

- Please obtain a current rate sheet from a customer service representative. This account is subject to variable rates that can be changed at any time at the bank’s discretion.

- BaZing member fee is $6/month with paper statement.

- ATM transactions do not apply. Maximum statement credit from debit card purchases, if receiving eStatements, not to exceed $5.00. Maximum statement credit from debit card purchases, if receiving paper statements, not to exceed $6.00. Transactions must hard-post to your account during the statement cycle to reduce the fee.

BaZing

|

Interest

|

Simply

|

Advantage Checking-DexterChecking With Interest for Age 60+ |

|

|---|---|---|---|---|

| Minimum Opening Balance | $50 | $50 | $50 | $50 |

| FREE Debit Card | ||||

| FREE Online Banking & Bill Pay | ||||

| FREE eStatements | ||||

| FREE Mobile Banking App | ||||

| Unlimited Check Writing | ||||

| Optional Overdraft Protection | ||||

| Cell Phone Protection* | ||||

| ID Theft Aid* | ||||

| Roadside Assistance* | ||||

| BaZing Savings Network | ||||

| Earns Interest** | ||||

| FREE Box of Checks | ||||

| Monthly Service Charge | $51 fee reduced by $0.10 for every debit card purchase2 | $0 for balances $500 and over | $0 | $0 |

- Cell Phone Protection is subject to a $50 deductible and additional restrictions. Roadside Assistance is subject to a $64.95 fee per use and additional restrictions. Enroll in ID theft aid through BaZing website. Please see a customer service representative for a printout of the terms and conditions. Terms and conditions are also available when you sign into your account at BaZing. Insurance products are not a deposit, not FDIC insured, not an obligation or guaranteed by the bank, its affiliates or any other government agency.

- Please obtain a current rate sheet from a customer service representative. This account is subject to variable rates that can be changed at any time at the bank’s discretion.

- BaZing member fee is $6/month with paper statement.

- ATM transactions do not apply. Maximum statement credit from debit card purchases, if receiving eStatements, not to exceed $5.00. Maximum statement credit from debit card purchases, if receiving paper statements, not to exceed $6.00. Transactions must hard-post to your account during the statement cycle to reduce the fee.

Checking Designed for Your Life

Whether you want a free checking option or an interest-earning account, we have a checking solution that’s right for you. All of our personal checking accounts can be opened with just $50 and include a free instant-issue debit card, free digital banking and money management tools, free electronic statements, and unlimited check writing.

Review our checking account features to find the best option for the way you live.

BaZing

Checking-Ozarks

Checking With Benefits

Enjoy everyday banking convenience plus valuable benefits, like cell phone protection, identity theft aid, roadside assistance and automatic participation in the BaZing Savings Network.

Enjoy everyday banking convenience plus valuable benefits, like cell phone protection, identity theft aid, roadside assistance and automatic participation in the BaZing Savings Network.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $51 fee reduced by $0.10 for every debit card purchase2 |

Interest

Checking-Ozarks

Checking With

Interest

Make your money work harder with our interest-bearing checking account that keeps your cash accessible for when you need it. The higher your balance, the more you’ll earn with our tiered interest rates.

Make your money work harder with our interest-bearing checking account that keeps your cash accessible for when you need it. The higher your balance, the more you’ll earn with our tiered interest rates.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $0 for balances $500 and over |

Simply

Checking-Ozarks

A Free Account for Everyone

Manage your finances quickly and confidently, with no monthly maintenance fees or hidden charges. Our free checking account is ideal for anyone just starting their financial journey.

Manage your finances quickly and confidently, with no monthly maintenance fees or hidden charges. Our free checking account is ideal for anyone just starting their financial journey.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $0 |

Advantage Checking-Ozarks

Checking With Interest for Age 60+

Get rewarded for experience. Designed for individuals age 60+, this option has no minimum balance requirement, offers generous tiered interest rates and includes a free box of checks every year.

Get rewarded for experience. Designed for individuals age 60+, this option has no minimum balance requirement, offers generous tiered interest rates and includes a free box of checks every year.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Cell Phone Protection* | |

| ID Theft Aid* | |

| Roadside Assistance* | |

| BaZing Savings Network | |

| Earns Interest** | |

| FREE Box of Checks | |

| Monthly Service Charge | $0 |

Review our checking account features to find the best option for the way you live.

- Cell Phone Protection is subject to a $50 deductible and additional restrictions. Roadside Assistance is subject to a $64.95 fee per use and additional restrictions. Enroll in ID theft aid through BaZing website. Please see a customer service representative for a printout of the terms and conditions. Terms and conditions are also available when you sign into your account at BaZing. Insurance products are not a deposit, not FDIC insured, not an obligation or guaranteed by the bank, its affiliates or any other government agency.

- Please obtain a current rate sheet from a customer service representative. This account is subject to variable rates that can be changed at any time at the bank’s discretion.

- BaZing member fee is $6/month with paper statement.

- ATM transactions do not apply. Maximum statement credit from debit card purchases, if receiving eStatements, not to exceed $5.00. Maximum statement credit from debit card purchases, if receiving paper statements, not to exceed $6.00. Transactions must hard-post to your account during the statement cycle to reduce the fee.

BaZing

|

Interest

|

Simply

|

Advantage Checking-OzarksChecking With Interest for Age 60+ |

|

|---|---|---|---|---|

| Minimum Opening Balance | $50 | $50 | $50 | $50 |

| FREE Debit Card | ||||

| FREE Online Banking & Bill Pay | ||||

| FREE eStatements | ||||

| FREE Mobile Banking App | ||||

| Unlimited Check Writing | ||||

| Optional Overdraft Protection | ||||

| Cell Phone Protection* | ||||

| ID Theft Aid* | ||||

| Roadside Assistance* | ||||

| BaZing Savings Network | ||||

| Earns Interest** | ||||

| FREE Box of Checks | ||||

| Monthly Service Charge | $51 fee reduced by $0.10 for every debit card purchase2 | $0 for balances $500 and over | $0 | $0 |

- Cell Phone Protection is subject to a $50 deductible and additional restrictions. Roadside Assistance is subject to a $64.95 fee per use and additional restrictions. Enroll in ID theft aid through BaZing website. Please see a customer service representative for a printout of the terms and conditions. Terms and conditions are also available when you sign into your account at BaZing. Insurance products are not a deposit, not FDIC insured, not an obligation or guaranteed by the bank, its affiliates or any other government agency.

- Please obtain a current rate sheet from a customer service representative. This account is subject to variable rates that can be changed at any time at the bank’s discretion.

- BaZing member fee is $6/month with paper statement.

- ATM transactions do not apply. Maximum statement credit from debit card purchases, if receiving eStatements, not to exceed $5.00. Maximum statement credit from debit card purchases, if receiving paper statements, not to exceed $6.00. Transactions must hard-post to your account during the statement cycle to reduce the fee.

Checking Designed for Your Life

Whether you want a free checking option or an interest-earning account, we have a checking solution that’s right for you. All of our personal checking accounts can be opened with just $50 and include a free instant-issue debit card, free digital banking and money management tools, free electronic statements, and unlimited check writing.

Review our checking account features to find the best option for your life.

High-Interest Checking-Columbia

Checking With Interest

Make your money work harder and earn a competitive 4.00% APY1 on balances up to $20,000 when you make 12 debit card transactions per month and have at least one monthly direct deposit or auto debit.

Make your money work harder and earn a competitive 4.00% APY1 on balances up to $20,000 when you make 12 debit card transactions per month and have at least one monthly direct deposit or auto debit.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Minimum Daily Balance | |

| Earns Interest** | |

| FREE Box of Checks |

Dime-a-Time Checking

Checking With Debit Card Rewards

Get rewarded for everyday spending. Exclusively for our Columbia branch customers, this account gives you a 10-cent credit every time you swipe or insert your debit card for purchases of at least $5.2

Get rewarded for everyday spending. Exclusively for our Columbia branch customers, this account gives you a 10-cent credit every time you swipe or insert your debit card for purchases of at least $5.2

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Minimum Daily Balance | |

| Earns Interest** | |

| FREE Box of Checks |

Simply

Checking-Columbia

A Free Account for Everyone

Manage your finances quickly and confidently, with no monthly maintenance fees or hidden charges. Our free checking account is ideal for anyone just starting their financial journey.

Manage your finances quickly and confidently, with no monthly maintenance fees or hidden charges. Our free checking account is ideal for anyone just starting their financial journey.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Minimum Daily Balance | |

| Earns Interest** | |

| FREE Box of Checks |

Advantage Checking-Columbia

Checking With Interest for Age 60+

Get rewarded for experience. Designed for individuals age 60+, this option has no minimum balance requirement, offers generous tiered interest rates and includes a free box of checks every year.

Get rewarded for experience. Designed for individuals age 60+, this option has no minimum balance requirement, offers generous tiered interest rates and includes a free box of checks every year.

| Minimum Opening Balance | $50 |

|---|---|

| FREE Debit Card | |

| FREE Online Banking & Bill Pay | |

| FREE eStatements | |

| FREE Mobile Banking App | |

| Unlimited Check Writing | |

| Optional Overdraft Protection | |

| Minimum Daily Balance | |

| Earns Interest** | |

| FREE Box of Checks |

Review our checking account features to find the best option for your life.

- APY = Annual Percentage Yield. APY accurate as of November 1, 2017, rates may change at any time. $50.00 minimum to open account. For accounts opened in the Columbia, MO market only. Balances up to $20,000 receive APY of 3.04% and balances over $20,000 earn 0.21% APY on accounts meeting the following requirements: 1) Twelve (12) debit card transactions hard-posted during the regular monthly statement cycle (does not include ATM transactions). AND 2) Have at least one recurring ACH debit or credit transaction hard-post during each regular monthly statement cycle. If qualifications are not met, all balances earn 0.01% APY.

- Account holders will receive $0.10 back for every swipe of their First Midwest Bank debit card up to 200 swipes per month ($20.00 reward maximum). No minimum balance is required, and no monthly service fee is charged. Available for personal accounts only. Account must be opened at First Midwest Bank’s Columbia locations. No length of time is required for the account to be open. The reward will be credited to the account at the end of each statement cycle. A transaction must be hard-posted to the account during the statement cycle to receive a reward. If the account is closed before the cycle date, the accrued reward for that statement cycle will be forfeited.

High-Interest Checking-ColumbiaChecking With Interest |

Dime-a-Time CheckingChecking With Debit Card Rewards |

Simply

|

Advantage Checking-ColumbiaChecking With Interest for Age 60+ |

|

|---|---|---|---|---|

| Minimum Opening Balance | $50 | $50 | $50 | $50 |

| FREE Debit Card | ||||

| FREE Online Banking & Bill Pay | ||||

| FREE eStatements | ||||

| FREE Mobile Banking App | ||||

| Unlimited Check Writing | ||||

| Optional Overdraft Protection | ||||

| Minimum Daily Balance | ||||

| Earns Interest** | ||||

| FREE Box of Checks | ||||

- APY = Annual Percentage Yield. APY accurate as of November 1, 2017, rates may change at any time. $50.00 minimum to open account. For accounts opened in the Columbia, MO market only. Balances up to $20,000 receive APY of 3.04% and balances over $20,000 earn 0.21% APY on accounts meeting the following requirements: 1) Twelve (12) debit card transactions hard-posted during the regular monthly statement cycle (does not include ATM transactions). AND 2) Have at least one recurring ACH debit or credit transaction hard-post during each regular monthly statement cycle. If qualifications are not met, all balances earn 0.01% APY.

- Account holders will receive $0.10 back for every swipe of their First Midwest Bank debit card up to 200 swipes per month ($20.00 reward maximum). No minimum balance is required, and no monthly service fee is charged. Available for personal accounts only. Account must be opened at First Midwest Bank’s Columbia locations. No length of time is required for the account to be open. The reward will be credited to the account at the end of each statement cycle. A transaction must be hard-posted to the account during the statement cycle to receive a reward. If the account is closed before the cycle date, the accrued reward for that statement cycle will be forfeited.

“I have been very pleased with the service from First Midwest. I have used them for over 20 years, and on more than one occasion, they have gone above and beyond to help me.”

- Alanna

Online Banking

We know you’re busy. That’s why we make it easy to bank virtually anytime, anywhere you have internet access. Use our powerful, secure online and mobile banking tools to stay on top of your finances.

- View your balance and transactions.

- Create a budget and track spending.

- Pay bills and transfer funds.

- Make mobile check deposits.

- Send money to family and friends.

Reorder Checks

Need to order new checks for your First Midwest Bank account? Visit Deluxe, our secure third-party provider, to choose your design and easily order personalized checks in minutes.

Order Checks

Lost or Stolen Card

Please contact us immediately if your debit card has been lost or stolen. A customer service representative will assist you in deactivating your card and ordering a replacement card for your account. If you suspect your card has been used fraudulently, please contact your local branch as soon as possible.

To report a lost or stolen card, call 573-785-8461. After hours/weekend, call 888-263-3370.

Online Banking

We know you’re busy. That’s why we make it easy to bank virtually anytime, anywhere you have internet access. Use our powerful, secure online and mobile banking tools to stay on top of your finances.

- View your balance and transactions.

- Create a budget and track spending.

- Pay bills and transfer funds.

- Make mobile check deposits.

- Send money to family and friends.

Reorder Checks

Need to order new checks for your First Midwest Bank account? Visit Deluxe, our secure third-party provider, to choose your design and easily order personalized checks in minutes.

Order Checks

Lost or Stolen Card

Please contact us immediately if your debit card has been lost or stolen. A customer service representative will assist you in deactivating your card and ordering a replacement card for your account. If you suspect your card has been used fraudulently, please download our Credit Dispute Form.

To report a lost or stolen card, call 573-785-8461. After hours/weekend, call 888-263-3370.

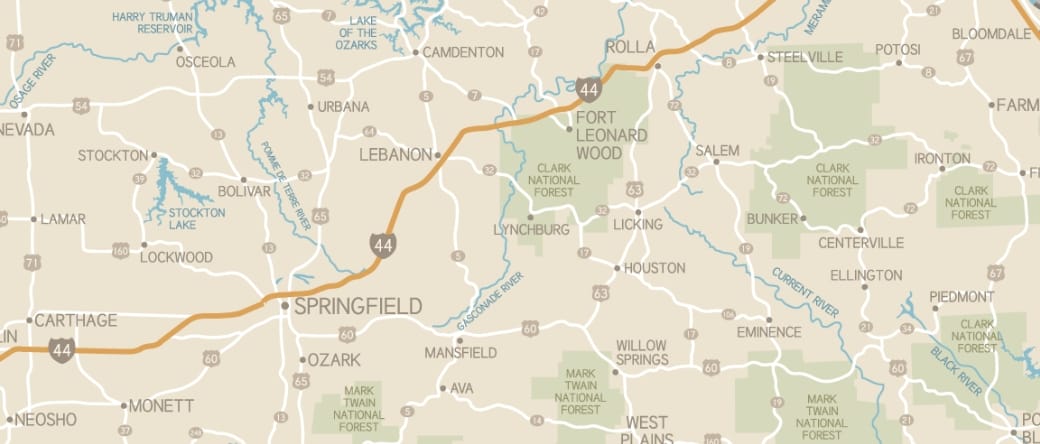

We’re Right Around the Corner

We have several conveniently located branches throughout Missouri. Stop by and visit us today — we can’t wait to see you!

Explore the Possibilities

Start (or continue) your savings journey with confidence.

Get the funds you need for big plans and unplanned expenses.

The Greenlight® app and debit card let kids take control of their finances, guided by you.